Financial Services : Fraud Detection

Fraud Detection

Leading Financial institution in North America, needed automation capabilities to detect the fraudulent activities related to lending, such as applying false loan applications, creating fake collateral, or manipulating credit scores.

A fraud detection solution using Azure Synapse and Azure ML Services helps the lending financial institutions accurately identify and prevent fraudulent activities related to lending, such as loan fraud and identity theft.

Solutions

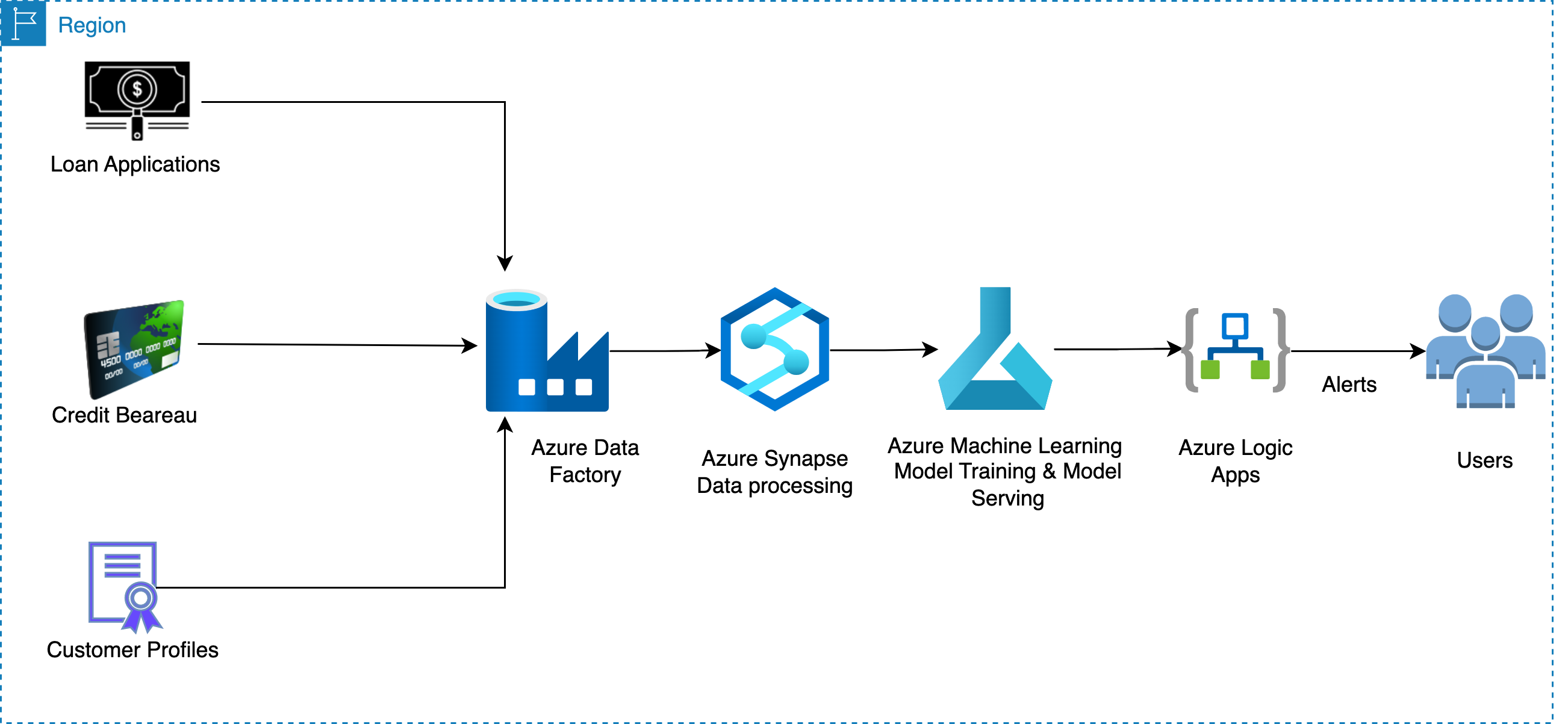

- Data Ingestion: Data from various sources, such as loan applications, credit bureau reports, and customer profiles, is ingested into an Azure Synapse workspace, which serves as a central repository for data.

- Data Preparation: The data is cleaned, transformed, and prepared for analysis using Azure Synapse Analytics. Synapse Analytics is used to automate the data preparation process, making it easier to manage and scale.

- Feature Engineering: Azure Machine Learning is used to create features from the cleaned and prepared data. Feature engineering is the process of selecting the most relevant data features and transforming them into a format that can be used for machine learning.

- Model Training: Azure Machine Learning is used to train a lending fraud detection model using the features generated in the previous step. The model can identify unusual patterns, behaviors, and trends that may indicate fraudulent lending activities.

- Model Deployment: The trained model is deployed as a web service using Azure Machine Learning. The web service can be accessed by other applications and services to perform real-time lending fraud detection.

- Alerting: The results of the lending fraud detection model are used to generate alerts using Azure Logic Apps. These alerts can be sent to risk management teams, compliance officers, or other stakeholders in real-time.

Benefits:

- Solution complied with GDPR regulations

- Accuracy of 90% + in identification of the fraudulent activities

- Better collaboration between team members due to notebook environment